Fiat – automobile brand, currency system and preliminary stage of digital currencies

The vast majority of readers will probably think of an Italian automobile brand when they hear the word “Fiat”. In the financial world, however, the word describes the currency system we use, such as the Euro. In the distant past, commodity money dominated. For example, a bag of rice was exchanged for a jug of milk, or a horse was exchanged for a gold ore. The objects of exchange in commodity money therefore have a so-called intrinsic value. Thus the rice can be eaten, the milk drunk and the horse used as a productive livestock. Gold ore, on the other hand, is a very limited and at the same time sought-after commodity.

In simple terms:

Commodity money includes valuable, useful or rare things that served the daily needs!

The opposite of commodity money is the fiat money or fiat currency, which is used today. Fiat money has no intrinsic value. The value of money is lent by the power of the government and the numerous agents that accept the currency as a means of payment.

In simple terms:

Fiat money is controlled by the state and accepted by the masses as means of payment!

A clear trend has been apparent for years: The Euro is now no longer used as a note or a physical coin in everyday life. Rather, most payment transactions are now made by credit card, EC card or even smartphone. Digital money is therefore playing an increasingly important role in our society.

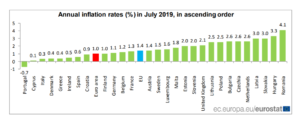

Everything used to be… cheaper

Whether it is the Euro, US-Dollar, Pound Sterling or Indian Rupee, the world’s currencies are regulated by the state. Another common feature is the explicitly targeted inflation of fiat money. In simple terms, inflation describes the continuing increase in the price level of goods and services and thus the depreciation of the currency. Put simply, whether it is the ice cream in the café, the carton of milk in the supermarket or the repair of handicrafts, everything becomes more and more expensive over time. Inflation in Germany was 1.5 % in 2019.

This process is controlled by the amount of money in circulation. The European Central Bank is allowed to generate fresh money at any time and also destroy it again. It therefore controls the money supply according to demand and thus indirectly regulates the inflation of the currency.

The European Central Bank (ECB) is aiming for an annual inflation rate of 2%!

Bitcoin, on the other hand, is not regulated by a single government institution such as the ECB, but decentrally by users around the world. A state-controlled inflation, as is the case with all other fiat currencies worldwide, does not exist for Bitcoin. The amount of Bitcoins is controlled by an algorithm.